What is PayPal's End-Game for Cryptocurrency?

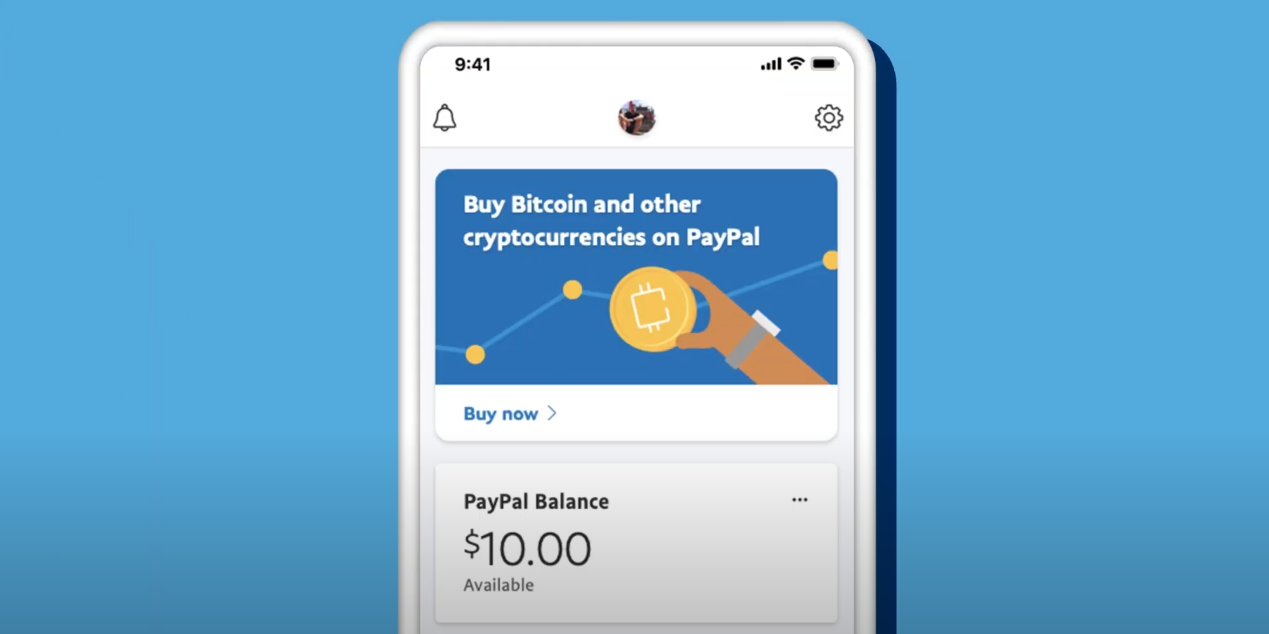

PayPal have delivered what is perhaps the biggest step forward for mainstream cryptocurrency adoption. Users will now be able to buy, sell and hold Bitcoin, Ethereum, Litecoin and Bitcoin Cash within the PayPal environment and crucially, users will be able to pay the millions of merchants that support PayPal directly from their cryptocurrency wallet without the merchant needing to change a thing.

More than just numbers, the introduction of someone like PayPal into the mix will help to push the usability and interoperability that the cryptocurrency world needs. Everyday consumers aren't going to be using hardware wallets, generating their own private keys and running a full Bitcoin node. The everyday user needs something that's simple that gets out of the way, allowing them to buy whatever they need. As much as I'm a true nerd that enjoys playing with cryptography hardware, when I want to buy something I don't want complexity - I want simple and reliable.

PayPal are experts at this.

What's next for PayPal and Crypto?

It is absolutely in PayPal's interests to look to cryptocurrencies for a low cost base payment solution, and when it comes to cross-chain transactions they will have accrued a sufficient reserve of Bitcoin, Litecoin, etc. that any 'conversion' will just be bits flipped in PayPal's own database rather than an actual transaction.

The way I see it, PayPal have are two potential directions to go:

1. PayPal becomes a front for Central Bank Digital Currencies that are coming.

2. PayPal launches their own cryptocurrency or maybe they already have - see below.

Whether PayPal achieve these through their own effort or by acquisition, I guarantee that what we've seen thus far is only the beginning and PayPal are already reported to be in talks to acquire BitGo, a digital asset platform used by Ripple and Zcash.

Here's how those options might pan out...

Central Bank Digital Currencies

Most major central banks have been researching the idea of taking their traditional 'fiat' currencies and either converting them to digital currencies or running a parallel digital currency. This approach is known as a Central Bank Digital Currency or CBDC and it's a hot topic at the moment.

Asia often leads in payment innovation and the same is happening with CBDCs. The People's Bank of China has already conducted a CBDC trial, the Bank of Korea is conducting a trial in 2021 and the Bank of Japan has signalled a programme of investigation.

Many, like the European Central Bank are taking an open minded but measured stance, their Report on a digital euro shows a desire "to be prepared to issue a digital euro" and an international consortium of central banks (including the US Federal Reserve) has already started to outline the "foundational principles and core features" that a CBDC should have.

It's unclear whether all of these CBDCs would operate using blockchain or cryptocurrency technologies but I'd almost guarantee that soon after they begin to operate, they will be supported by PayPal.

PayPal's Own Cryptocurrency - PayPal Cash?

Another potential end-game is that ultimately PayPal will issue their own digital currency. For any organisation to launch a successful digital currency they would need to meet a few key criteria. They would need a large, active user base that likes and trusts them, relationships with merchants, integrations with existing payment networks and the ability to deliver a great customer experience - with a bonus of being unencumbered by legacy technology and processes.

PayPal ticks all of those boxes, and with regards to the last one they have the potential to be much more agile than say, a bank or a traditional payment networks that are very tightly bound by the need to work with existing processes and tight regulations.

Actually, I believe at least to some extent that PayPal already have a digital currency. It may not be a cryptocurrency in the technical sense but customers already have the option of holding a balance of funds inside their PayPal 'wallet'.

Thinking back to the economics of the situation, if your money is already inside PayPal it costs nothing for PayPal to move it to another PayPal account. Because PayPal hold a sufficient balance of every major fiat currency and cryptocurrency, it's all just data in a database so there's no money actually needs to go through a costly foreign exchange. Your PayPal balance is effectively a global multi-currency stablecoin, but there's little motivation for people to hold a PayPal balance other than convenience or accident (e.g. a refunded fee).

But what if PayPal silently transferred the concept of the PayPal balance to a blockchain, and what if they used that blockchain to launch their own cryptocurrency? PayPal would instantly have a cryptocurrency that could be used independently of traditional financial rails, that already had hundreds of millions of active users over which it cost them nothing to process transactions - making merchant fees instant margin.

The most interesting part of that suggestion is perhaps that they may already have done this behind the scenes - we would never know until they're ready to launch.